Corporate Governances

Corporate Governance

Overview of Corporate Governance

- Basic policy on corporate governance

Our mission is “With an unwavering and enterprising spirit and an open corporate culture, we will supply the best solutions in a flexible and timely fashion, working to realize a process of “co-creation” by which we contribute both to the sustainable development of the international community and the happiness of employees.” We believe that realization of this ideal would, in itself, be meeting the expectations of all stakeholders. To execute our basic policy, we have adopted the following guidelines: complying with laws and regulations with integrity, aiming for future development and creativity, making and executing decisions promptly and accurately, and catching the business trends and staying ahead of the curve. We are strengthening our corporate governance through the implementation of these guidelines. - Overview of the corporate governance system and reasons for adopting the system

<The Board of Directors>

The Board of Directors consists of 6 Directors who are not members of the Audit and Supervisory Committee, including 2 Outside Directors, and 3 Directors who are also members of the Audit and Supervisory Committee, including 2 Outside Directors (as of the date of submission of this report). The Board of Directors makes decisions on important matters in Group management. It also audits and supervises business execution. The Board of Directors holds a regular monthly meeting, as well as extraordinary meetings in the event of occurrence of a fact that needs urgently addressing. The term of office of Directors who are not members of the Audit and Supervisory Committee is one year. The term of office of Directors who are also members of the Audit and Supervisory Committee is two years.

<The Committee of Executive Officers>

The Company introduced an executive officer system in 2003. The committee consisted of 12 members (including 4 Directors) as of the time of preparing this report. The Committee of Executive Officers meets monthly to share information. Each Executive Officer strives to improve day-to-day operations in their area of responsibility.

<The Audit and Supervisory Committee>

The Company has established an audit and supervisory committee to strengthen its functions to audit and supervise the Board of Director’s execution of its duties and to increase agility and speed in decision making by separating auditing and supervision from business execution. Since decisions on important matters at meetings of the Board of Directors and day-to-day business execution are overseen from an objective and neutral standpoint by Outside Directors who possess extensive insight and knowledge, the Company believes that the management oversight function is sufficiently ensured through the current system. The committee consisted of three Directors (a full-time Director and two Outside Directors) as of the time of preparing this report. These Directors audit and supervise the legality and adequacy of the execution of duties of the Directors who are not members of the Audit and Supervisory Committee. The committee holds a regular monthly meeting, as well as extraordinary meetings as needed. Each member of the Audit and Supervisory Committee follows the policies set by the committee and requests Directors who are not members of the Audit and Supervisory Committee, among others, to provide reports and conduct investigations as needed. They audit and supervise management in cooperation with the Internal Audit Section and the accounting auditor.

<Nomination and Compensation Committee>

We established an optional nomination/remuneration committee in May 2020 as an advisory panel for the Board of Directors for the purposes of enhancing the independence, objectivity, and accountability of the functions of the Board of Directors concerning the appointment and dismissal of the President & CEO director and Directors with specific titles and nomination of director nominees as well as the appropriateness of remuneration of Directors (except members of the Audit and Supervisory Committee), etc. and enriching further the corporate governance system.

The committee, which consists of three or more Directors appointed by the Board of Directors (a majority of them are Outside Directors), deliberates the matters concerning the nomination/remuneration of Directors, including drafting proposals for the appointment and dismissal of Directors to be discussed at the General Meeting of Shareholders, drafting the Policy on Decisions on the Content of the Remunerations etc. for Individual Directors (excluding Directors who are members of the Audit and Supervisory Committee) to be discussed at the Board of Directors, and proposing the nomination and remunerations of Individual Directors (excluding Directors who are members of the Audit and Supervisory Committee) including proposed details of the Content of the Remunerations etc. for each Individual Directors to be discussed at the Board of Directors, and reports to the Board of Directors. The Board of Directors’ Regulations stipulate to the effect that the Board of Directors shall respect the content of reports of the nomination/remuneration committee when making decisions. This nomination/remuneration committee functions as both a nomination committee and a remuneration committee.

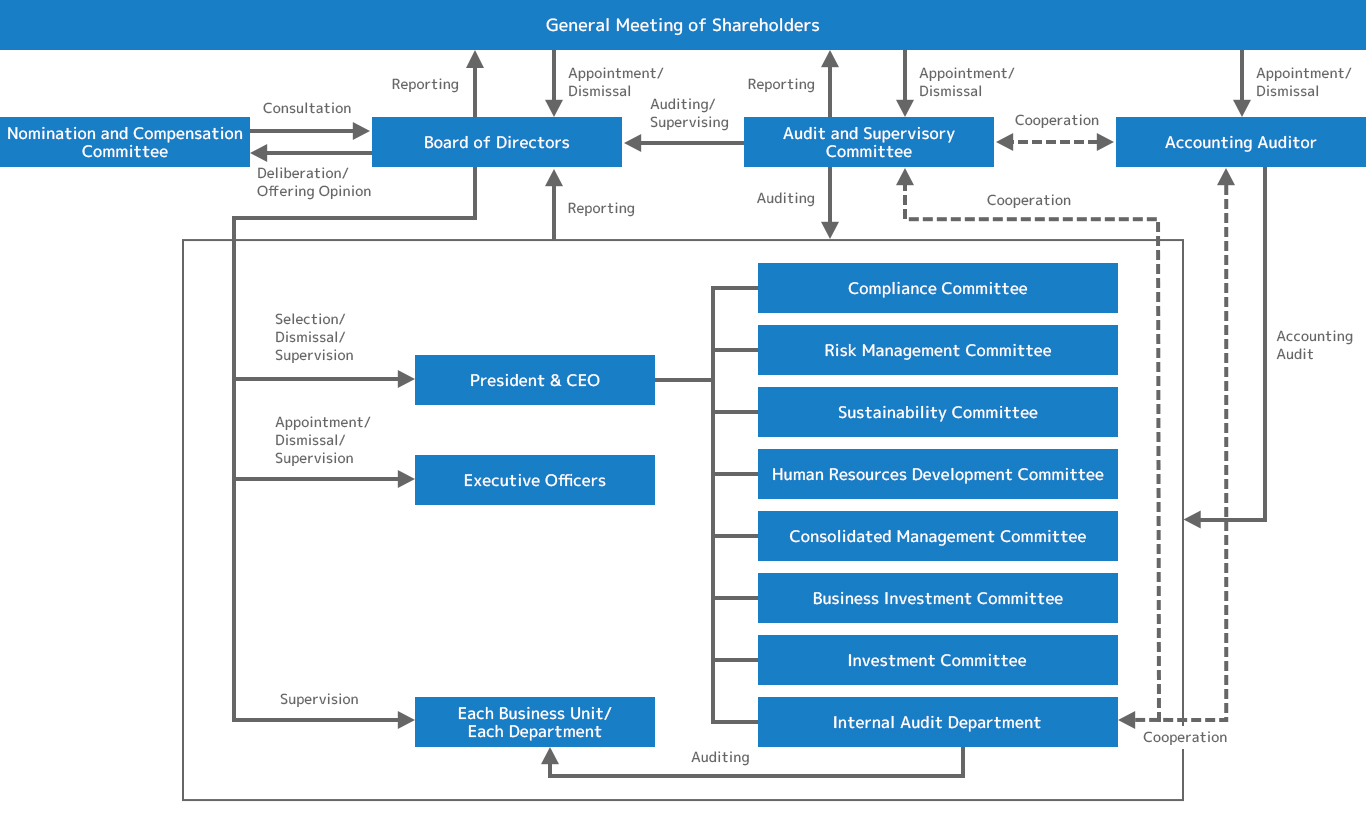

Chart of Corporate Governance Structure

Attendance at Board of Directors meetings in FY2024

| Position | Name | Board of Director meetings | Audit and Supervisory Committee meetings |

| President & CEO | Masanobu Shintani | 14/14 (100%) | – |

| Managing Director | Toshiaki Mizusawa | 14/14 (100%) | – |

| Director & Executive Officer | Kenichi Shindo | 14/14 (100%) | – |

| Director & Executive Officer | Mitsuyasu Hirasawa | 14/14 (100%) | – |

| Outside Director | Hirotaka Sugihara | 14/14 (100%) | – |

| Outside Director | Mitsuo Ogawa | 14/14 (100%) | – |

| Director (Full-Time Audit and Supervisory Committee Member) | Hiroshi Shirai | 14/14 (100%) | 10/10 (100%) ※1 |

| Outside Director (Audit and Supervisory Committee Member) | Asako Hasegawa | 14/14 (100%) | 15/15 (100%) |

| Outside Director (Audit and Supervisory Committee Member) | Kuniaki Kobayashi | 14/14 (100%) | 15/15 (100%) |

Evaluation of the Effectiveness of the Board of Directors

To maintain and improve corporate governance, Sanyo Trading evaluates the effectiveness of its Board of Directors every year. The overview of implementation guidelines and evaluation results for the fiscal year ended September 30, 2023 is as follows.

(1) Implementation guidelines

- Evaluation targets

10 Directors (including 4 Outside Directors (including 2 Audit and Supervisory Committee Members)) for the fiscal year ended September 30, 2023 - Evaluation process

Conduct a questionnaire questioning those subject to evaluation where the respondents gave their name, perform an analysis and evaluation, and report the results regarding the effectiveness of the Board of Directors to the Board of Directors. - Evaluation items

– Structure of the Board of Directors

– Operation of the Board of Directors

– Effectiveness of overall management

(2) Overview of evaluation results

As a result of the analysis of the questionnaire responses, we confirmed that the effectiveness of the Board of Directors continued to be ensured.

In terms of the structure of the Board of Directors, the evaluation indicated that a system for appropriately making important management decisions and audit and supervising the execution of business was in place. Regarding the effectiveness of management overall, the evaluation indicated that, overall, the direction of management strategies and the formulation of management plans were appropriately considered.

As a future challenge, we will strengthen our efforts to enhance our disclosure of information since the disclosure of non-financial information, including information about ESG matters, is limited. We will continue to strive to improve the effectiveness of the Board of Directors and pursue the enhancement of corporate value over the medium to long term.

Basic Policy for Internal Control System

The Group has built and operates an internal control system as described below. The Group will continue to review and improve the internal control system in response to revisions to laws and regulations and changes in the business environment.

Systems to Ensure the Proper Business Operation of the Group

(1) System to ensure that the directors and employees of the Company and its subsidiaries will execute their duties in compliance with laws and regulations and the Articles of Incorporation

- The Company has established Sanyo Trading Group’s Code of Conduct Manual a code specifying how the officers and employees of the Company and its subsidiaries should act in accordance with the Group’s mission and in compliance with laws and regulations and the Articles of Incorporation. To ensure the effectiveness of the manual, the President appoints a Director responsible for compliance. In addition, the Company has established the Compliance Committee under its Compliance Regulations and has built a system where the committee supervises compliance companywide. The committee periodically reports the status of compliance to the Board of Directors. To increase understanding of laws and regulations and internal regulations among the Company’s officers and employees, the Company distributes the Sanyo Trading Group Compliance Handbook and also provides a Self-Discipline Checklist for individuals to reflect on their own words and actions, based on the belief that the Company’s free and open-minded culture is something that is created through an awareness of self-discipline, in other words, through individuals that act based on high ethical standards, in compliance with laws and regulations and with good sense and responsibility as members of society. In addition, the Company conducts a compliance awareness survey once a year to gain an understanding of levels of compliance awareness and the risk of compliance violations and also earmarks two months of the year as months for strengthening compliance, in an effort to strengthen the internal compliance system through the provision of internal training and departmental discussions on measures to address compliance violations and risks that might lead to violations.

The Group has a system where the subsidiaries report their situation periodically to the Board of Directors and the divisions in charge and may report their situation regularly by participating in meetings of the Committee of Executive Officers or by other means under the Subsidiary Management Regulations and the Standards for Decision-Making Authority. Depending on the matters stipulated by related regulations, the Company secures compliance by making final decision at the headquarters’ Board of Directors. - The Internal Audit Section audits whether the business activities of the Company and its subsidiaries are efficient and comply with laws and regulations, internal regulations and trade practices, among other rules, and reports the audit results to the Board of Directors.

- Regarding whistleblower hotlines for reporting acts that violate laws and regulations or social norms or acts at risk of violating them, the Company’s Human Resources & General Affairs Department is the supervising department internally and it appoints a third party (lawyer) externally to operate a whistleblower hotline. The Company has established internal regulations to prohibit the unfair treatment of informants and protect them.

- To fulfill our social responsibilities as the Group and work to achieve both a sustainable international community and medium- to long-term corporate growth, we have established the Sustainability Committee. The committee will consider measures to solve social issues including reducing our environmental impact, and will ensure that the measures are taken. We have established a system for deliberating on environmental and social issues and evaluating measures the Group will implement, and the committee regularly reports the status of initiatives to the Board of Directors. In addition, we have positioned health and productivity management and respect for human rights in the S (social) domain. To promote health and productivity management, we regularly convene the Health and Productivity Management Committee, which is a subcommittee of the Sustainability Committee, and review policies and issues in relation to the health and productivity management of employees. In addition, we have established a human rights policy to ensure we respect human rights and treat all stakeholders, including employees, fairly and equitably in our business activities. Furthermore, as a responsible company that supports and is a signatory to the United Nations Global Compact (UNGC), we have also committed to the Ten Principles in the four areas of responsibility.

(2) System for Storage and Management of Information on the Directors of the Company’s Execution of Their Duties

The Company has established a system where important documents and electromagnetic records, including Board of Directors’ meeting materials and the minutes of the Board of Directors meetings, are stored and managed and can be perused by the Directors and Auditors as needed under the Document Handling Rules and other internal regulations.

(3) Regulations and Systems Related to Management of Risks of Losses at the Company and Its Subsidiaries

- The Company identifies a variety of risks caused by business execution using standards that are consistent as much as possible, and aims to have a comprehensive risk management while ensuring sound management and maximizing shareholder value.

- Under the Risk Management Regulations, the Company clarifies its risk management system, specifying the divisions responsible for different types of risks and managing risks and managing risks exhaustively and comprehensively. The President appoints a Director responsible for risk management. The Company has the Risk Management Committee, which monitors various risks attributable to the Company’s operations and risks that the Company should avoid for business continuity, and promptly responds to changes. The committee regularly provides to the Board of Directors an overview of risk management, including countermeasures to be taken if risks to be avoided occur.

- For appropriate authorization and business execution according to business risk, the Company has established an internal consensus-based approval system (ringi system) based on the Administrative Authority Regulations. The Company has established an Investment and Financing Committee that, before discussion at the Board of the Directors, deliberates important investment proposals from the viewpoint of profitability, strategic importance, safety, feasibility, and compliance, evaluates risks associated with investment and financing both qualitatively and quantitatively, and seeks to mitigate or avoid them.

- The Company has established a system where it prepares for losses at its subsidiaries through interviews with the representatives of the subsidiaries, among others, as needed, under the Risk Management Regulations.

(4) Systems to Ensure That the Directors of the Company and Its Subsidiaries Will Execute Their Duties Efficiently

- The Company has built a system where it sets management targets and formulates management plans for the Group and examines the plans, comparing them and progress towards their achievement. For efficient execution of duties based on decisions made by the Board of Directors, the tasks are assigned to each Director and Executive Officer under internal regulations, including the Organization Rules, Administrative Authority Regulations, and Standards for Decision-Making Authority. The Company seeks to clarify the decision-making rules by reviewing the relevant regulations and developing the delegation of authority system. In addition, the Company seeks to expand the checks and balances system developing a system to ensure that the Directors perform their duties systematically, properly and efficiently.

- Important investment and financing proposals are deliberated in advance by the Investment and Financing Committee so that decisions are made by the Board of Directors based on sufficient discussion. The administrative divisions and other specialist departments that make up this committee carefully examine the terms and conditions that will affect whether the proposal is approved or rejected and submit opinions from their respective specialist viewpoints. The proposing department then considers measures to address any issues in light of the results of deliberations at the Investment and Financing Committee and presents these to the Board of Directors.

- The Company has its subsidiaries formulate management plans in line with the Group’s management targets and compares the plans and progress towards their achievement.

(5) System to Ensure the Proper Business Operation of the Group Consisting of the Company and Its Subsidiaries

To ensure the proper business operation of the Group, the Company has defined a management mission shared by the Group companies and has formulated the Subsidiary Management Regulations, which specify basic rules for the Company and its subsidiaries cooperating for the Group’s prosperity and development of overall business operations, and the Standards for Decision-Making Authority Related to Management of Subsidiaries. The Company has appointed supervisors in charge of each subsidiary who supervise the subsidiaries’ business and receive reports from the subsidiaries about their operations as necessary.

(6) Systems to Ensure Effective Audits by the Audit and Supervisory Committee

- Directors and employees who shall assist with the duties of the Audit and Supervisory Committee

The Audit and Supervisory Committee has reported that it will not have any Directors or employees who shall assist the committee with its duties for some time to come. - Independence of Directors and employees who shall assist with the duties of the Audit and Supervisory Committee

Refer to 1. - Systems for reporting to the Audit and Supervisory Committee

The Group’s Directors and employees submit statutory documents, resolutions and reports at important meetings, and important documents about the Directors who are not members of the Audit and Supervisory Committee on the Directors’ execution of their duties to the Audit and Supervisory Committee and report matters that may have significant effects on the Company as necessary.

In addition, the Company regularly receives reports from the managers of its subsidiaries and confirms the status of their management in cooperation with the Internal Audit Section and the corporate auditors of the subsidiaries. - System to ensure that persons who reported to the Audit and Supervisory Committee will not be treated unfairly as a result

The Group has established a whistleblowing system to prevent the unfair treatment of persons who give information to the Audit and Supervisory Committee and protect the informants. - Policy on advance payments and other expenses resulting from the Audit and Supervisory Committee members’ execution of their duties

If members of the Audit and Supervisory Committee claim advance payments of expenses for their execution of duties, the Company prepays the expenses unless it decides the expenses are unnecessary for the execution of duties. - System to ensure effective audits by the Audit and Supervisory Committee

The Audit and Supervisory Committee members participate in the meetings of the Board of Directors and the Committee of Executive Officers and other important meetings, and exchange opinions with the President & CEO, accounting auditor and Internal Audit Section as necessary.

(7) System Related to Antisocial Forces

- Basic Policy for Exclusion of Antisocial Forces

Article 3 of the Antisocial Forces Handling Regulations of the Company states: “We shall never make payments to antisocial forces or have relationships with them. The Company’s officers and employees shall not allow any unjustified involvement of antisocial forces and shall be determined to exclude them to adhere to social justice and win the trust of customers, the market, and society.” - Preparation for Excluding Antisocial Forces

The Company has adopted the Sanyo Trading Group’s Code of Conduct Manual, Antisocial Forces Check Manual, among other regulations, and communicates its code of conduct for excluding antisocial forces to the entire Group to ensure full compliance.

Reason for the Appointment of Outside Directors and Outside Auditors

| Name | Audit & Supervisory Committee member | Independent officer | Supplementary explanation about relationships with the Company | Reason for appointment |

| Hirotaka Sugihara | 〇 | No applicable information | The Company has determined that Mr. Sugihara will fulfill his duties from a neutral position, taking advantage of his extensive experience and knowledge and deep insight, which he has achieved through work at a trading company for many years. We examined his personal, capital and business relationships with the Company and his stake in the Company and have determined that he is independent and is not at risk of having conflicts of interest with general shareholders. | |

| Mitsuo Ogawa | 〇 | No applicable information | The Company has determined that Mr. Ogawa will fulfill his duties from a neutral position, taking advantage of his deep insight, which he has achieved through human resources and organizational consulting for many years. We examined his personal, capital and business relationships with the Company and his stake in the Company and have determined that he is independent and is not at risk of having conflicts of interest with general shareholders. | |

| Asako Hasegawa | 〇 | 〇 | No applicable information | Ms. Hasegawa is conversant with financial accounting and tax practice as a certified public accountant. The Company has determined that she will fulfill her duties from a neutral position, taking advantage of her insight and experience. We examined his personal, capital and business relationships with the Company and his stake in the Company and have determined that he is independent and is not at risk of having conflicts of interest with general shareholders. |

| Kuniaki Kobayashi | 〇 | 〇 | No applicable information | The Company has determined that Mr. Kobayashi will fulfill his duties from a neutral position, taking advantage of his extensive experience and knowledge and deep insight as a lawyer. We examined his personal, capital and business relationships with the Company and his stake in the Company and have determined that he is independent and is not at risk of having conflicts of interest with general shareholders. |

Implemetation of Measures for Shareholders and Other Stakeholders

1.Initiatives to revitalize the General Meeting of Shareholders and to facilitate the exercise of voting rights

| Explanation | |

| Sending the notice to call a General Meeting of Shareholders early | We strive to send the notice to call a General Meeting of Shareholders early and post the notice on the Company’s website. |

| Avoiding days on which many companies hold shareholders’ meetings | We hold our General Meeting of Shareholders in December. We arrange the schedule to facilitate the attendance of many shareholders at the meeting. |

| Exercise of voting rights by electromagnetic means | It is possible to exercise voting rights via the Internet. |

| Participating in the electronic voting platform for investors Other initiatives to improve the environment for the exercise of voting rights by institutional investors | Those shareholders that are institutional investors can use the electronic voting platform for investors. |

| Providing convocation notice (summary) in English | A convocation notice (in English) is posted on our website. https://www.sanyo-trading.co.jp/eng/ir/ |

2.IR activities

| Explanation | Explanation by representative | |

| Creating and publishing the disclosure policy | We post the disclosure policy on the Company’s website. | |

| Holding regular explanatory meetings for analysts and institutional investors | We hold meetings after the closing of accounts for the first half and the annual closing. | Yes |

| Posting of IR materials on the website | On the website, we post materials such as accounting summaries, timely disclosure materials, annual securities reports and quarterly reports. | |

| Establishing the IR department (person in charge) | The Corporate Planning Department (Head of the Corporate Planning Department) is in charge of IR. |

3.Initiatives related to respect for stakeholders

| Explanation | |

| Environmental conservation activities, CSR activities, etc. | We have achieved ISO 14001 certification and consider environmental conservation in our business activities. Registration date: September 2004; renewal date: September 2022; expiration date: September 9, 2025 |

| Formulation of policy, etc. on the provision of information to stakeholders | We believe that providing information to stakeholders appropriately in a timely manner is important, and offer the information on the website and at company information sessions. |

Compliance

We have established Sanyo Trading Group’s Code of Conduct Manual as a guideline for officers and employees to act in accordance with our corporate mission, and to comply with laws and Articles of Incorporation. To ensure the effectiveness of the manual, the President appoints a Director responsible for compliance. In addition, Sanyo Trading has established the Compliance Committee and has built a system where the committee supervises compliance companywide. The committee periodically reports the status of compliance to the Board of Directors.

We have established a system for the Group companies to regularly report on their situations through periodic reporting to the Head Office Board of Directors of and the responsible division, as well as attendance at executive meetings. The Internal Audit Section conducts audits on the business activities of our company and Group companies and reports the results to the Board of Directors.

Sanyo Trading has an internal whistleblower hotline and a compliance consultation desk for reporting acts that violate laws and regulations or social norms, or acts at risk of said violations. In addition, as a compliance consultation desk, it has appointed third parties (lawyers) externally. Sanyo Trading has established internal regulations to prohibit the unfair treatment of whistleblowers and provide them with protection.

Risk Management

Sanyo Trading identifies a variety of risks caused by business execution using standards that are consistent as much as possible and aims to have a comprehensive risk management while ensuring sound management and maximizing shareholder value.

Specifically, we establish responsible departments according to types of risks in accordance with regulations, and we clarify the management structure by comprehensively managing the risks. The President appoints a Director responsible for risk management, and in addition, establishes the Risk Management Committee. The Committee monitors various risks attributable to Sanyo Trading’s operations and risks that it should avoid for business continuity, and promptly responds to changes along with regularly providing to the Board of Directors the status of comprehensive risk management, including countermeasures to be taken if risks occur.

We have established a system under which it prepares for losses at Group companies through interviews with such as the representatives of Group companies, as needed based on the regulations.

Group Tax Policy

Basic Policy

Sanyo Trading Corporation and its subsidiaries (hereafter “the Sanyo Trading Group”) recognize that tax payment is our obligation. The Sanyo Trading Group strives to file and pay taxes appropriately and in a timely manner, and to establish and maintain mutual trust and fairness with all relevant tax authorities.

Tax Compliance

The Sanyo Trading Group complies with all applicable tax laws, tax treaties, and regulations of each country and region where the Sanyo Trading Group conducts business. The Sanyo Trading Group is committed not to engage in transactions without economic substance that are intended to avoid taxes or manipulate profits contrary to the spirit of all applicable Tax Rules.

Tax Governance

The Finance and Accounting Department, under the supervision of the Director in charge of administration, collaborates with relevant departments to address tax-related matters and associated risks. The Risk Management Committee is responsible for reviewing tax risks and reports significant matters to the Board of Directors, striving to establish a valid risk management system within the group.

Tax Cost Management

The Sanyo Trading Group is committed to eliminate double taxation, utilize favorable tax systems, and manage tax expenses appropriately.